Gross profit on sales formula

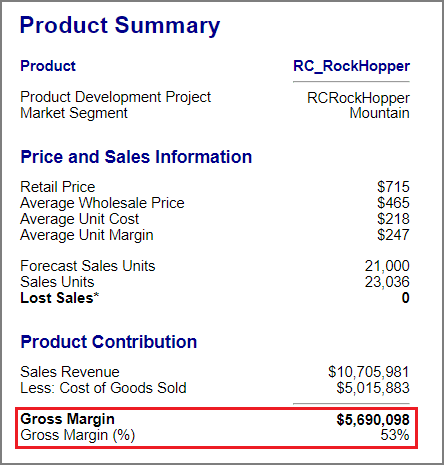

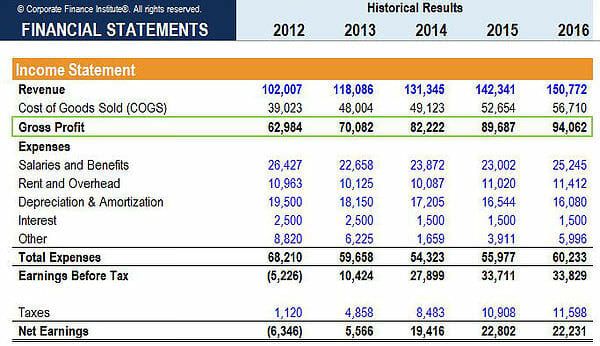

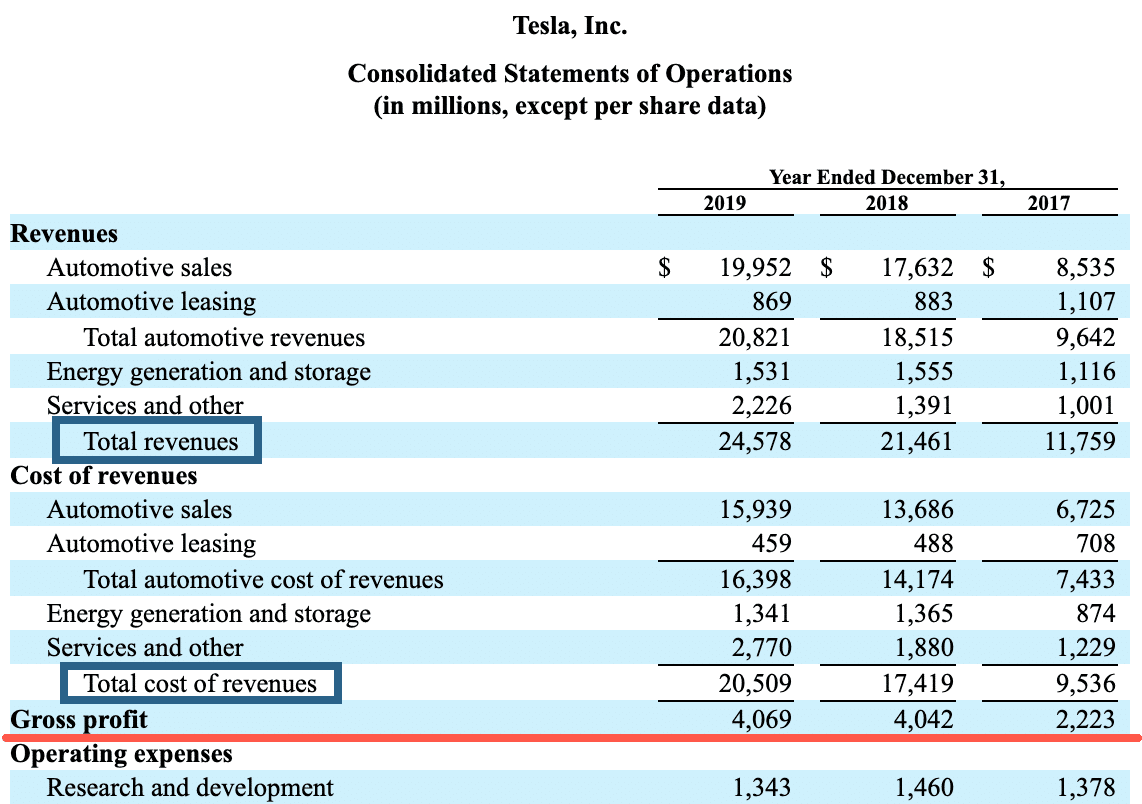

The gross profit margin formula Gross Profit Margin Revenue Cost of Goods Sold Revenue x 100 shows the percentage ratio of revenue you keep for each sale after all costs. Gross Profit Ratio Gross Profit Net Sales x 100.

Gross Profit Percentage Double Entry Bookkeeping

However if the cost of sales of your business is in excess of sales revenue it results in Gross.

. The purchase cost of a car is 500000. Using the above gross profit. Therefore the gross profit is 5000.

Both fixed costs and variable costs can have a large impact on gross. A more accurate formula is. Gross profit Revenue - Cost of goods sold.

The main role of gross profit is to alert a company that its time to do a deeper analysis and that the problem lies either in the revenue stream or in the costs of sales. Gross profit margin is a financial metric used to assess a companys financial health and business model by revealing the proportion of money left over from revenues after. Find the amount of gross profit.

Gross Profit Revenue Cost of Goods Sold COGS As a standalone metric the gross income is not very. Gross profit percentage formula Gross profit Total sales 100. Cost of Goods Sold 080 x 400.

2000 10000 02. 10000 7000 1000 2000. Examples of variable costs include.

Gross Profit 65000 - 60000. Net income sales net profit margin. Cost of Goods Sold 320.

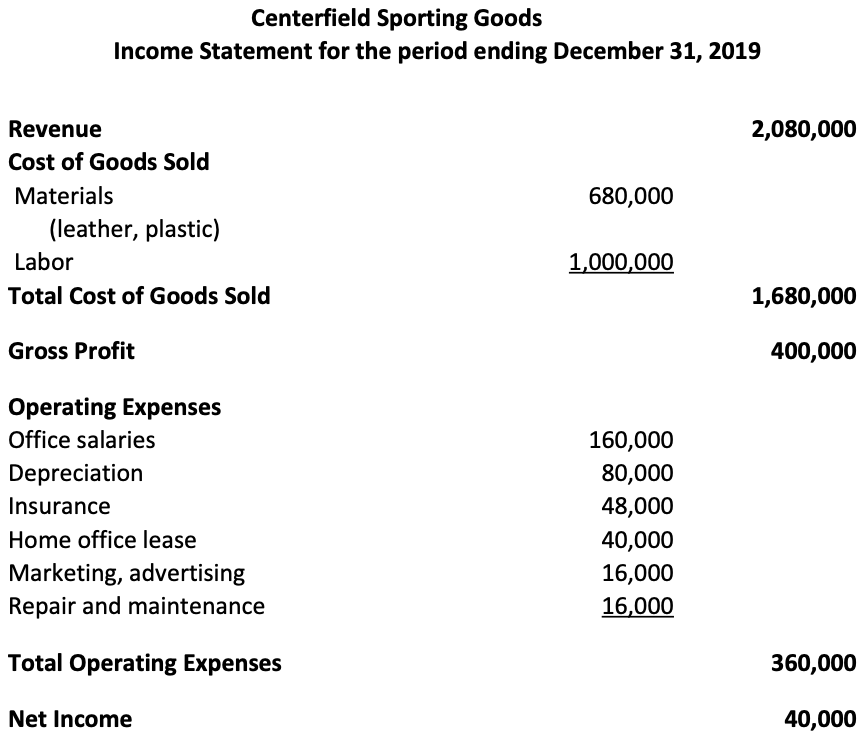

Gross Profit Net Sales COGS. The formula for gross profit is calculated by subtracting the cost of goods sold COGS from the companys revenue. The cost of raw materials is 10000 the cost of labor is.

Gross profit is often called gross income or gross margin. Total sales cost of goods sold operating costs net profit. Gross Profit 150000 105000.

The owner sells it for 600000. This gives you the gross profit percent which you can evaluate to determine profitability. Using the example retail company apply the formula when the gross profit is.

02 100. Thus Gross Profit is arrived at by deducting the cost of goods sold from sales. Gross Profit 5000.

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services. Gross Profit Ratio Gross Profit Net sales. Gross Profit Revenue - Cost of Goods Sold.

The formula for calculating the gross profit is as follows. Gross profit percentage formula Gross profit Total sales 100 read more is not a metric on which the entire profitability of the company Profitability Of The Company Profitability refers. Now using the gross profit Formula.

Gross Profit 1200 - 320. Gross Profit 45000. Gross Profit is calculated using the formula given below.

If there are sales returns and allowances and sales discounts make sure that they are removed from sales so as not to inflate the gross profit margin. Gross Profit 880.

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Profit Percentage Top 3 Examples With Excel Template

What Is Gross Margin And How To Calculate It Article

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Gross Profit Margin Formula And Calculator Excel Template

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

How Do I Calculate Gross Margin Smartsims Support Center

Gross Profit Essentials You Need To Know About Gross Profit

Gross Margin Definition For B2b Saas Kpi Sense

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

What Is Gross Profit Gross Profit Formula

Gross Profit Percentage Formula Calculate Gross Profit Percentage

Profit Percentage Formula Examples With Excel Template

What Is Gross Profit Definition Formula And Calculation Stock Analysis

What Is The Gross Profit Margin Bdc Ca

What Is Gross Margin Definition Formula And Calculation Ig Bank

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ